Making Tax Digital (MTD) will become compulsory for all VAT registered businesses from 1st April 2022. With this in mind, HMRC is reforming the sanctions for late submissions and late payments to make them more consistent across taxes. At LWA, we have detailed the penalty changes below, which will initially apply to VAT customers for accounting periods beginning on or after 1st April 2022.

How will the new penalty structure work?

How will the new penalty structure work?

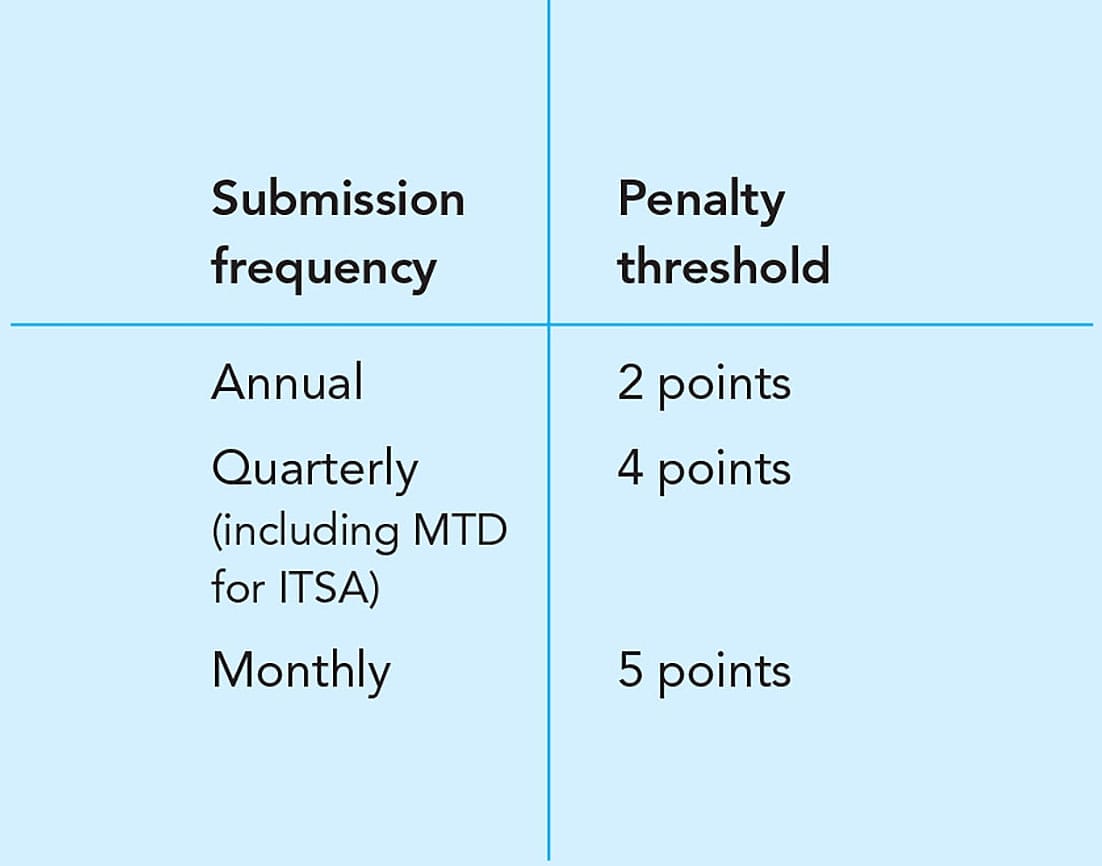

Taxpayers will no longer receive an automatic financial penalty if they fail to meet a submission obligation. Instead, they will incur a certain number of points for missed obligations and other information requested by HMRC not provided on time, before a financial penalty is applied. HMRC will notify taxpayers of a point received every time a submission deadline is missed. Once a certain threshold of points has been received, a financial penalty of £200 will be charged and the taxpayer will again be notified.

What are the new penalties from HMRC?

Below are two examples of how the new penalty structure could result in payment fines for a late return submission:

If you had a net VAT payment due of £100,000 for your June 2022 return, the due date would be 7th August 2022. The following would apply if you made the payment late on 1st November 2022Penalty of 2% fell due 22nd August 2022: £2,000

- Penalty of 2% fell due 8th September: £2,000

- Penalty of 4% p.a. from 9th September to 1st November: 53/365 x 4% = £580.82

- Interest at 2.5% over Bank of England (BoE) base rate (say 2.6%) from 8th August to 1st November: 85/365 x 2.6% = £605.48

Total penalty + interest = £5,186.30

If however, you made the payment late on 14th August 2022, the following penalty payment would apply:

- Interest only due for seven days.

- £100,000 x 7/365 x 2.6% = £49.86

Total penalty + interest = £49.86

Levying of penalty points and charges

Contact with HMRC is extremely important if you think you may be late in making a payment. If an approach to HMRC is made within 15 days or 30 days, the penalty will not be levied – as long as a Time To Pay (TTP) agreement has been made. It is expected that there could be a “light touch” applied for the first year with potentially no penalty applied if your VAT is paid within 30 days of due date, again, assuming the taxpayer has been in contact with HMRC.

How will penalty points be removed from my record?

Expiry of individual points over time

To prevent historic failures combining with occasional recent failures to cause a financial penalty, points will have a lifetime of two years; after which they will expire. This will be calculated from the subsequent month after the one in which the failure occurred. Points will not expire when a taxpayer is at the penalty threshold. This will ensure that they must achieve a period of compliance to reset their points.

Expiry of all points for compliance

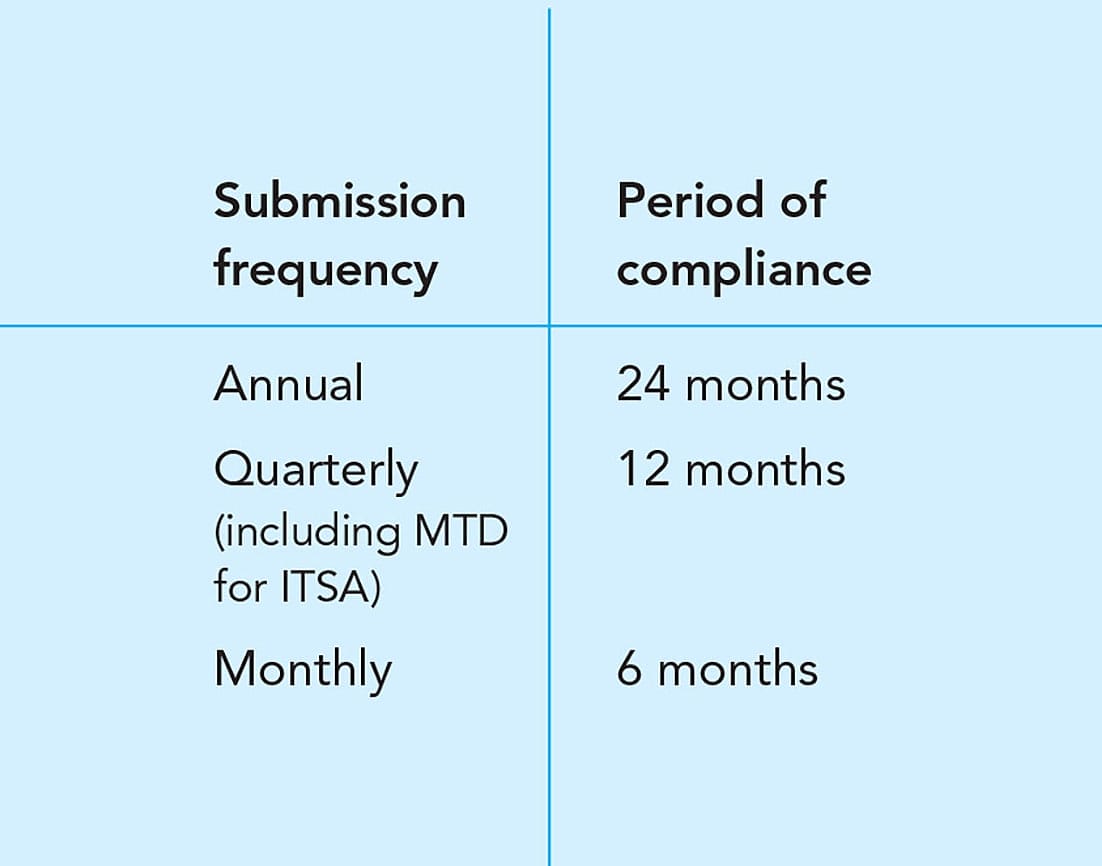

After a taxpayer has reached the penalty threshold, all the points accrued within that points total will be reset to zero when the taxpayer has met both of the following conditions:

- A period of compliance (that is, meeting all submission obligations on time for a specific period of compliance – see table below); and

- The taxpayer has submitted all the submissions which were due within the preceding 24 months. It does not matter whether or not these submissions were initially late.

The period of compliance will apply as per the adjacent table:

The period of compliance will apply as per the adjacent table:

If a taxpayer is at the penalty threshold and has achieved the period of compliance, but has not submitted outstanding submissions, they will remain at the penalty threshold and continue to be charged penalties for any further failures to make submissions on time.

Avoiding penalty points from HMRC

It goes without saying that in order to avoid being penalised by HMRC, ensure you have effective tax planning in place, and make sure you adhere to the new Making Tax Digital obligations before 1st April 2022. The team at LWA are here to guide you and help ensure you and your business comply with HMRC’s rules and regulations. If you are concerned and would like to speak to one of our friendly experts, please contact us in Manchester on 0161 905 1801 or in Warrington on 01925 830 830.

Our inhouse Digital Support expert, Bradley Allen-McKenna is available to help you get set up on Xero to meet your MTD obligations – it takes minutes to set up and Bradley is on hand to guide you through the easy-to-use cloud accounting software. Email bradley@lwaltd.com to find out more.

Les Leavitt, Leavitt Walmsley Associates – Chartered Certified Accountants

www.lwaltd.com